Enhanced Capital Allowances Overview

Enhanced Capital Allowances (ECAs) enable a business to claim 100% first-year capital allowances on their spending on qualifying plant and machinery.

Enhanced Captial Allowances were introduced as a means of neutralising the impact of the Climate Change Levy.

The Climate Change Levy was introduced in 2001 which is in essence a business tax on the use of energy sources that contribute to polluting emissions and greenhouse gases.

There are three schemes for ECAs, however the one we are interested in is the ‘energy-saving plant and machinery’.

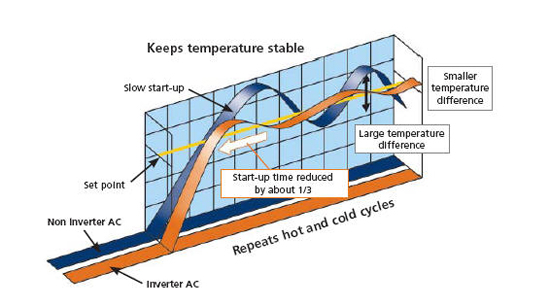

Such as, inverter driven ‘A/A rated’ air conditioning systems, high efficiency warm air heaters and condensing boilers.

Businesses can write off the whole of the capital cost of their investment in these technologies against their taxable profits of the period during which they make the investment.